Teaching Kids About Money: A Christian Parent’s Guide

As parents, we want our children to grow up confident, kind, and grounded in faith, but what about financially wise?

Money management isn’t just an adult skill; it’s a

life skill rooted in biblical wisdom. From the time they’re young, kids are watching how we spend, save, and give. By teaching them early, we’re not just setting them up for financial success — we’re shaping their character to reflect

God’s heart for stewardship, discipline, and generosity.

The goal isn’t to raise kids obsessed with money, it’s to raise faithful stewards who use money wisely and view it as a tool for God’s purpose.

1. Start with God’s View of Money

Proverbs 3:9 (NIV): “Honor the Lord with your wealth, with the firstfruits of all your crops.”

Everything we have: time, talents, and treasure belongs to God. Teaching kids this truth from the start builds a foundation of humility and gratitude.

You can begin by explaining that money is not “ours”; it’s

God’s resource entrusted to us to use wisely. When your child earns their first dollar, show them how giving even a small portion back honors Him.

💡 Tip: Have your child put a coin in a “Giving Jar” each week and talk about how that money helps others and honors God. These small moments teach eternal lessons.

2. Model What You Teach

Proverbs 22:6 (NIV): “Start children off on the way they should go, and even when they are old they will not turn from it.”

Children watch everything we do, especially when it comes to how we handle money. When they see you paying bills responsibly, setting a budget, or giving to your church, you’re showing them what biblical stewardship looks like in real life.

Don’t be afraid to let them see your financial conversations. If you make a mistake, be honest and explain what you learned. Authenticity builds trust and shows that financial wisdom grows with experience.

💡 Tip: Next time you tithe or give to a cause, let your kids be part of it, even if it’s clicking the button together on a giving app or placing the envelope in the offering plate.

3. Give Them Real Responsibility

It’s one thing to talk about money; it’s another to let your kids handle it. Give them small allowances tied to chores or responsibilities to help them understand that work produces reward.

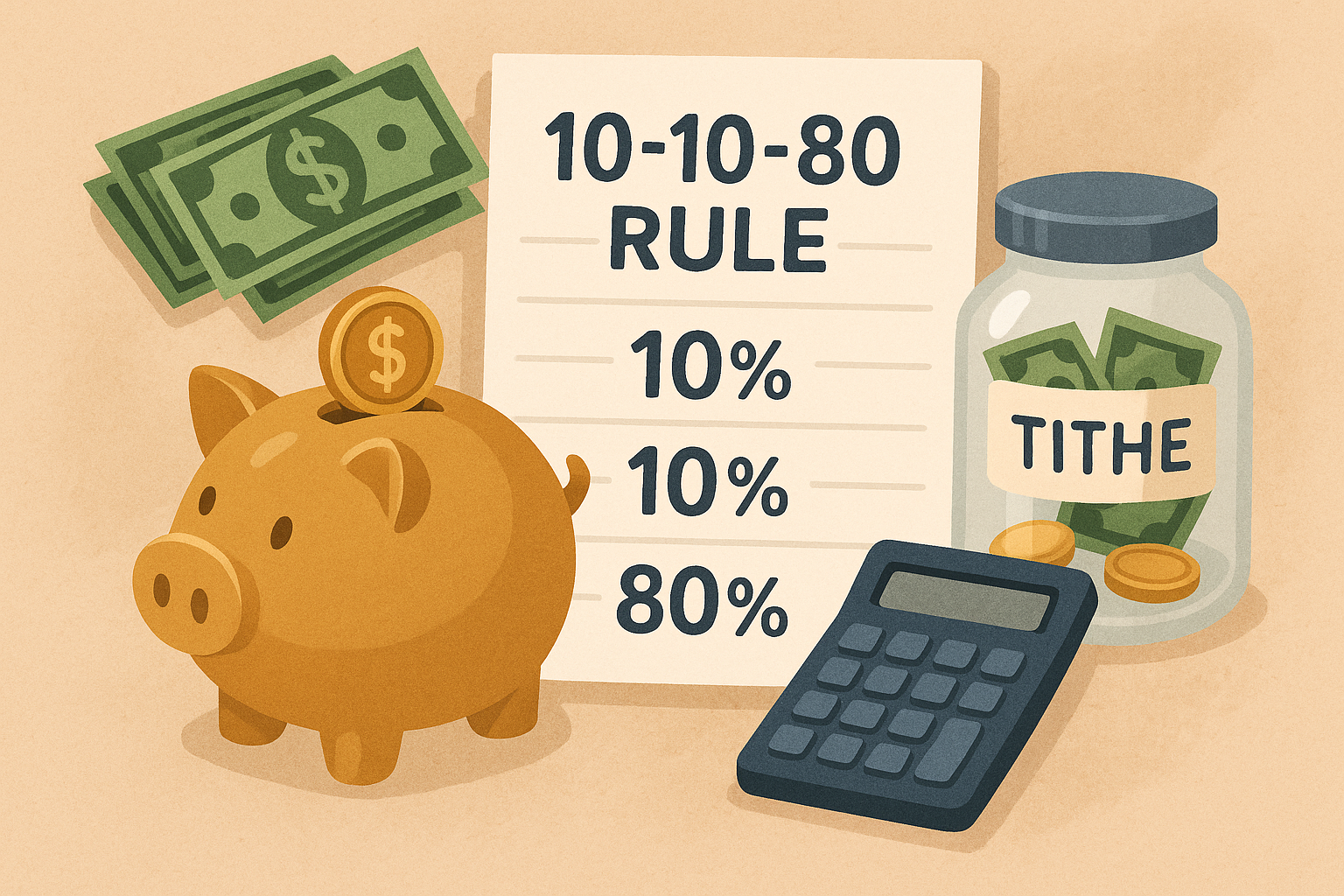

Encourage the “Give, Save, Spend” system, three jars or envelopes that help kids learn balance and decision-making.

💡 Example:

- Give: Church offering or helping a friend.

- Save: A long-term goal like a toy or trip.

- Spend: Something small to enjoy now.

When kids see that money can do more than just buy, but also bless, build, and serve, they’ll view it as a tool rather than a temptation.

4. Teach Generosity Early

Proverbs 11:25 (NIV): “A generous person will prosper; whoever refreshes others will be refreshed.”

Generosity is one of the greatest lessons we can teach our children. When giving becomes a family value, it shapes their hearts to mirror God’s heart.

Let them choose a charity or cause to support. Talk about what it means to give joyfully rather than out of obligation.

💡 Tip: Encourage them to give time, not just money. Volunteering, helping at church, or donating gently used clothes teaches that generosity is a lifestyle, not a transaction.

5. Turn Everyday Moments into Lessons

Kids learn best through life itself. Every grocery trip, birthday, or online order is a chance to teach something about money.

Explain the difference between needs and wants. Show how comparison shopping saves money. Let them see how you make decisions about value and stewardship.

💡 Faith Connection: Remind your child that patience, wisdom, and gratitude are all fruits of the Spirit that apply to money just as much as behavior.

When children connect faith to everyday money choices, it builds confidence and spiritual maturity at the same time.

6. Encourage Patience and Long-Term Thinking

Proverbs 13:11 (NIV): “Dishonest money dwindles away, but whoever gathers money little by little makes it grow.”

This is one of the hardest lessons to teach in an instant-gratification world, but one of the most valuable. Show your kids the joy of waiting for something they really want.

Help them set savings goals and track progress together. Celebrate when they reach it, not because of the thing they buy, but because of the discipline it took to get there.

💡 Tip: If they want a big item, offer to “match” their savings when they hit a milestone. It rewards patience and teamwork.

7. Celebrate Progress Together

Don’t underestimate the power of celebration! When your kids make good financial decisions, such as saving, giving, or resisting impulse spending, celebrate with them.

Pray together and thank God for the wisdom He’s giving your family. This reinforces the truth that money is not about control; it’s about

trusting God as the ultimate provider.

Every celebration builds confidence and faith. Children begin to see that when they follow God’s ways, blessings also follow.

Build a Legacy of Financial Faith

Raising financially wise children isn’t about perfection; it’s about progress, patience, and purpose. Every small conversation, every “money moment,” is a seed planted in their heart.

You’re not just teaching them how to handle money; you’re teaching them how to live with wisdom, generosity, and trust in God.

When your children grow up understanding that wealth is not about accumulation but stewardship, they’ll see that God’s plan for their life is bigger than any bank account.

Your example as a parent will echo for generations, a legacy of faith, wisdom, and financial freedom grounded in God’s Word.

So start today. Open your Bible. Open a conversation. And watch as your children grow into faithful stewards who honor God with every dollar, every decision, and every dream.

👉 Want to keep your family growing in faith and financial wisdom? Download our free 7-Day Proverbs & Paychecks Devotional to start applying biblical principles to your home’s finances, one day, one verse, and one habit at a time.